Update: How I paid for my kid’s camp this year

/UPDATE as of June 6, 2019: I just registered one of my children for their first overnight camp experience. I was able to use my Stash piggy bank to pay for 75% of it. If I had put more money away throughout the year, there’s no doubt I would have been able to cover the entire cost. But since it was my first year using Stash, I was more conservative with investing and moving money around between different funds. I think next year I’ll be a bit more bearish, now that I understand how the platform works and how automatic deposits are what work for me to ensure consistent saving. It felt incredibly good to be able to transfer my investments to liquid cash. Since Stash is all about microinvestments, there’s a bit more planning and strategizing than a traditional savings account (sorry if that is a memo from the Dept. of Obvious). It takes at least 2 days for these transactions to take place, so my advice is to give yourself a good week to sift through anything you want to sell so the money will be ready to transfer to your bank when you need it.

***

I live at the intersection where Spendthrift Avenue meets Frugal Lane. I live in a humble home built of fickle sticks under a flimsy roof where I have just about the same level of interest in running up credit card bills as I have in stockpiling my savings: about zero. I don't want the stress of dealing with debt nor do I want the long, plodding risk-averse life of being a miser. Whenever I share my lack of interest in Watching Money Work, a well-intended friend asks me if I've heard of Dave Ramsey. I think they are always disappointed that I do know about Dave Ramsey and do listen to his podcast but also that I do really think the (near?) obsessive focus so many Ramsey-ites adopt about their money is off-putting. Even if his methods are proven. Being super money-focused isn't my jam.

What is my jam is occasionally having fun with my dough. Spending it on others in small little ways that delight. Donating it to an organization I support. Socking away a few bones into my kids' college funds.

This is why I enjoy the Stash. It's about small, little, measurably consistent ways of saving money, that keeps it fun. To be honest, I don't know that it's the best way or even a wise way to save money, so I'm not putting all my pesos in this one bolso. What I do know is that when I opened my account in May, they gave me $5 to start. And now, at the end of August, I somehow have $100 that I didn't have a few months ago.

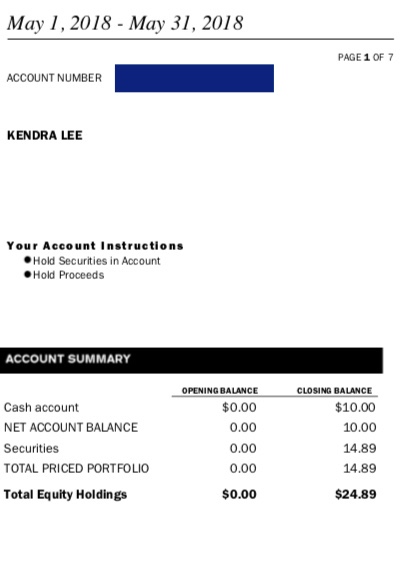

Here's the proof in the pudding. I'm showing you my debits and credits in the account.

In May, I invested the $5 minimum and ran with it. Invested $30 more of my own. Learned the platform to see how I could maximize my dollars.

The next month, I invested $20 more. Nothing earth-shattering happened, but I felt good knowing I had a consistent plan to stick some money in a digital drawer that nobody was going to touch.

In July, I was a big saver and put away another $20. I know. Eat your heart out, Dave Ramsey.

Last month, I put $10 into Stash, and moved some cash within the account into different stocks. Each month, I paid between $.50-$1 in fees.

Three months. I invested roughly $90 of my own money. And now I have $100. I've had fun rolling the dice with some microinvestments and learned a little bit more about the stock market. With Stash, you can invest in a mix of stocks and funds or identify specific companies where you want to send your pocket change.

Stash has a "Get $5, Give $5" that I'm happy to share here to start your investing fun.

As I mentioned, this isn't a magical piggy bank, but it's been a motivating force to save that was not all-consuming but actually fun and cultivated helpful habits that I hope to continue.